Note that accumulated depreciation doesn’t actually affect the property value until the home is sold. Accumulated real estate depreciation appears on the assets section of a balance sheet, as shown in the following example.Įxample of a Real Estate Balance Sheet Assets

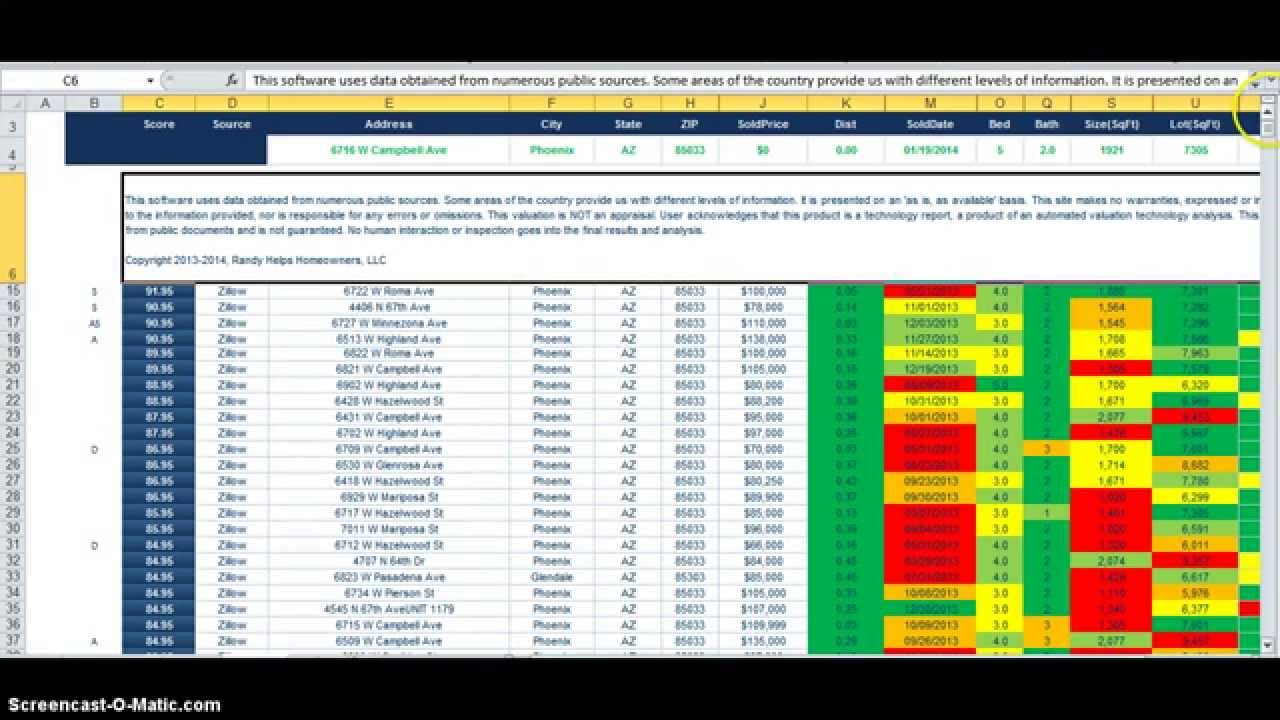

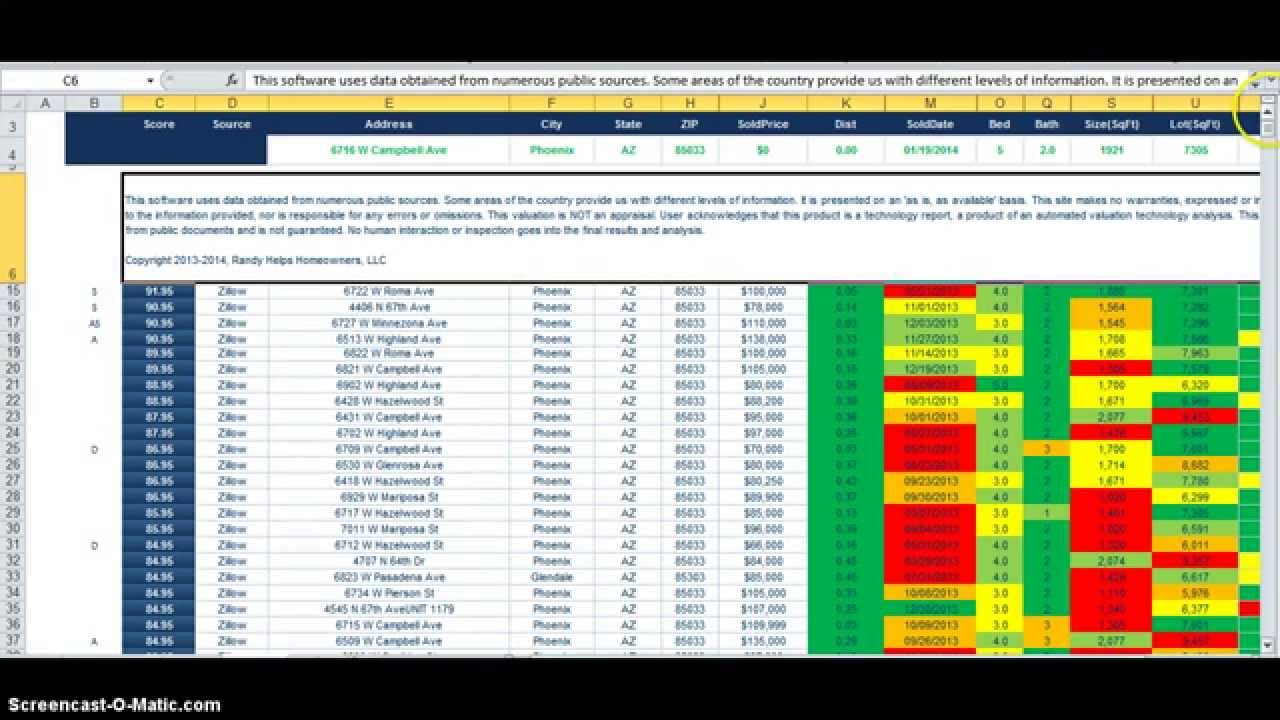

$110,000 / 27.5 years = $4,000 annual depreciation expense.Īfter three years, the accumulated depreciation would be $12,000. $120,000 home price – $10,000 lot value = $110,000 property value subject to depreciation. If the value of the single-family home lot is $10,000, the annual depreciation expense on the rental property would be $4,000 per year: The IRS allows residential investment real estate to be depreciated over 27.5 years, excluding the value of the land or lot. Now let’s take a look at the most common types of information included on a basic real estate balance sheet for a single-family rental home:Īccumulated Depreciation on a Balance Sheetįor this example, we’ll assume an investor purchased a single-family rental home three years ago for $120,000. Real Estate Assets – Real Estate Liabilities = Real Estate Equity or Net Worth. Equity: Calculated by subtracting liabilities from assets.Įquity in real estate is often thought of as a property’s net worth by using a simple formula:. Liabilities: Mortgage debt, credit card balances, money owed to vendors, property taxes, and refundable security deposits from a tenant. Assets: Real estate, appliances used in a rental, cash in a checking or savings account, and other real estate investments such as shares in an LLC or fractional ownership of a single-family home. There are three sections to a real estate balance sheet:

Automating a balance sheet can provide a snapshot of the current property market value and owner’s equity at any given point in time.Ī real estate balance sheet reports how much a property is really worth by subtracting liabilities from asset value.Real estate balances sheets provide important information such as the amount of cash on hand and potential tax liability when a property is sold.Key sections of a real estate balance sheet are assets, liabilities, and owner’s equity.

A real estate balance sheet is a key report investors use to monitor the long-term financial health of a rental property.

The real estate balance sheet provides a high level view of property performance by reporting assets, liabilities, and owner equity all in the same place. However, while many investors focus on metrics such as cash flow and net operating income, these two metrics only tell part of the story. A real estate balance sheet is one of the main financial reports that investors have access to.

0 kommentar(er)

0 kommentar(er)